Dear Friend,

I hope this note finds you well! I wanted to take a moment to check in and share a quick update as I get adjusted and into the swing of things at the Capitol. It’s been a busy few weeks, and I’m excited to let you know that my district office is officially open! Last week I was there meeting with local leaders about how I can best serve you. If you need anything or just want to stop by and say hello, please know that my door is always open. My office is located at 795 Ela Road, Suite 208, Lake Zurich, IL 60047. You can also get ahold of the district office at (224) 662-4544.

There’s been a lot happening in Springfield, and I want to keep you informed about some of the big issues affecting our state.

Darby Hills, Illinois State Senator, 26th District

District Office is Here to Help!

Had a busy week at the district office last week meeting with local leaders about how I can best serve our communities. My office is open and ready to help. Please reach out anytime! You can also visit the contact page on my website.

795 Ela Road, Suite 208, Lake Zurich, IL 60047

(224) 662-4544

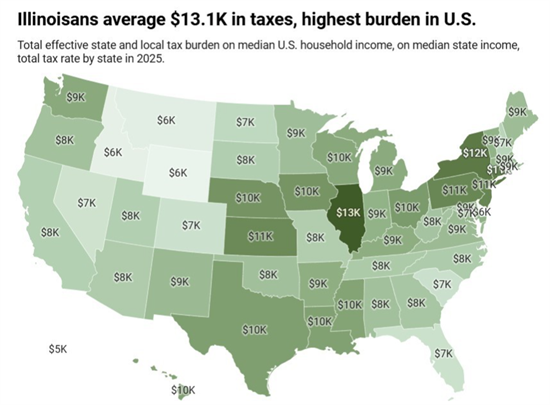

Illinois Now Highest Taxed State in the Nation

Illinois is now the highest-taxed state in the country, according to WalletHub’s latest annual study on state tax rates, a distinction that highlights the growing financial strain on families and job creators.

The report compares all 50 states and the District of Columbia across four key tax categories: real estate, vehicle property, income, and sales excise taxes. Illinois placed 51st overall, with 50th for real estate taxes and 47th for income taxes, making it the most burdensome state for residents and small businesses alike.

Illinois’ real estate tax rate is nearly 8%, second only to New Jersey, far above the national average. The study also found Illinois’ taxes are 51.8% higher than the U.S. average, with New York as the next closest at 34.9%. In contrast, states like Alaska, Delaware, and Wyoming impose the lowest taxes, creating more favorable conditions for families and job creators.

Additionally, WalletHub’s national survey revealed that 70% of Americans are more concerned about inflation than taxes, and nearly one-third would rather serve on jury duty than file their taxes. For Illinois families and entrepreneurs, these high tax rates exacerbate the state’s ongoing economic and fiscal challenges.

Illinois continues to face the highest tax burden in the nation, sparking ongoing discussions about how to address the impact on the state’s economic future.

Urgency for Illinois State Senators as Friday Deadline Looms

The deadline to pass substantive bills out of committee is fast approaching. Lawmakers in both the Senate and the House have until Friday, March 21st, to move bills that have originated in their respective chambers out of committee.

More than 2,000 Senate Bills and 4,000 House Bills have been filed in the General Assembly since it began its work in January. A majority of these bills are unlikely to advance before the upcoming deadline.

Lawmakers do have the option to file an extension request for legislation if it isn’t called before March 21st, but it historically becomes much more difficult to pass a bill into law if it doesn’t pass out of committee before this significant deadline.

Follow Me on Social Media

Stay connected and informed! Follow me on Facebook and Instagram for updates on legislation, community events, and how I am working for you.

Hills’ Highlights